Local School Tax Rate

China Spring ISD operates on a July 1 fiscal year, which means the budget must be adopted annually by June 30. The China Spring ISD School Board adopts the school budget during the June board meeting and typically receives an update on the current budget every month, all while planning for the next fiscal year.

Our school district is committed to being good stewards of our fiscal resources and tax dollars. China Spring ISD is audited annually by an independent auditing firm, meeting the requirements set forth by the Texas Education Agency (TEA). The financial integrity rating system of Texas (FIRST) tests the financial performance of school districts across the state. Since 2003, China Spring ISD has consistently earned a superior rating, the highest rating available, for financial performance.

The China Spring ISD School Board adopts the local property tax rate each year while the county appraisal district determines the market value of homes and business property within the district. School districts do not have input when it comes to market value determinations.

Understanding Public School District Tax Rates

A school district's tax rate is made up of two separate rates that support and maintain two separate funds. These funds have separate purposes and specific rules outline how these funds are spent.

Maintenance & Operations Tax Rate

Maintenance and operations (M&O) tax rate represents the largest portion of taxes collected from the community. The M&O taxes fund the general operations of the school district such as:

Salaries

Utility bills

School supplies

Fuel

Safety and security

Nursing staff

Custodial services

Transportation

According to survey data from the Texas Association of School Boards, nearly 85% of M&O funds go to covering personnel costs, like paying salaries for teachers, bus drivers, and support staff.

Interest & Sinking Tax Rate

Interest and sinking (I&S) tax rate is set by financial institutions based on the district's bond repayment schedule. Bonds pay for new school facilities, renovations of existing school facilities, and significant infrastructure upgrades.

I&S taxes can only be used to pay voter-approved debt from bond elections.

China Spring ISD Tax Rate

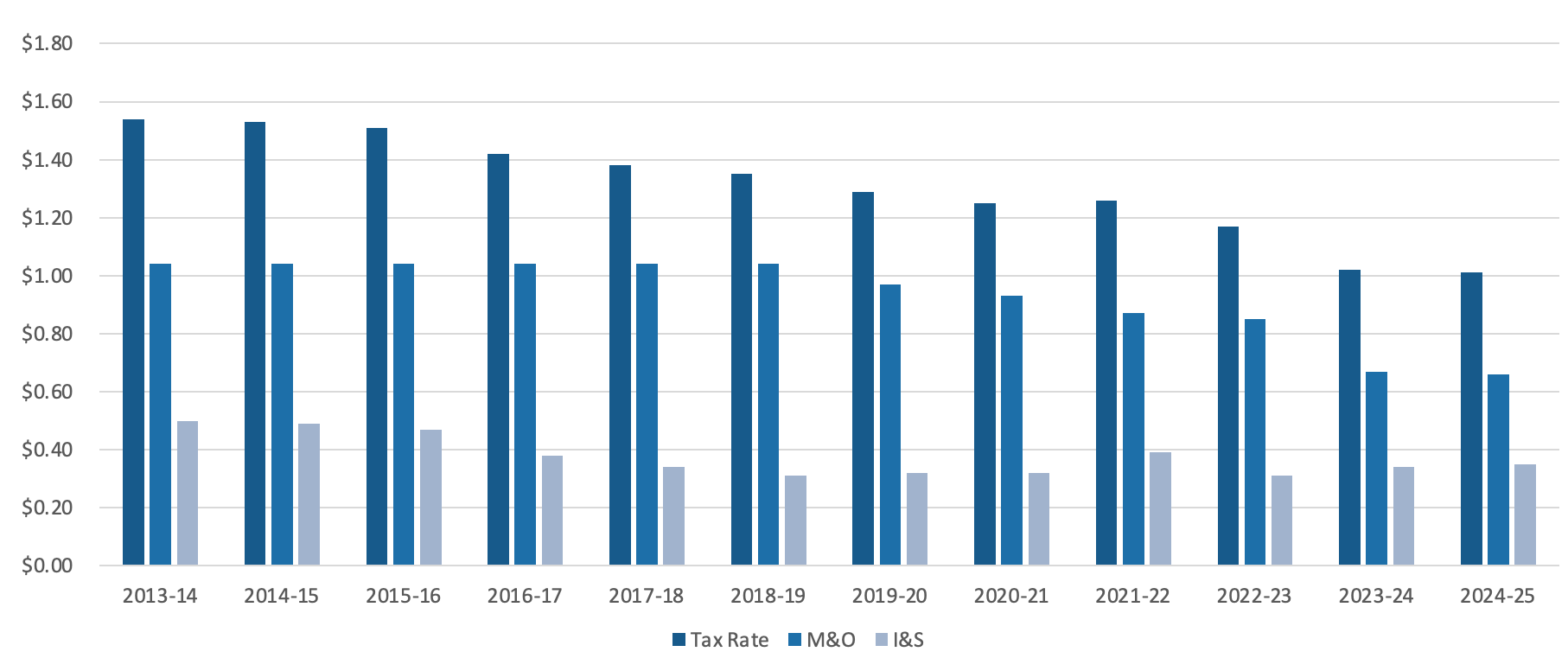

The M&O and I&S tax rates combine to create the China Spring ISD tax rate. Due to changes in school finance and tax compression laws, the school tax rate decreased from $1.54 per $100 assessed valuation in 2013 to $1.01 this year. Since 2013, the China Spring ISD tax rate has dropped 53 cents.

In 2021, the China Spring community approved a bond to build a new elementary campus, career & technical education classrooms and laboratories, and a high school competition gymnasium. The I&S rate increased by 7 cents to cover the voter-approved debt. Since the 2021 bond election, China Spring ISD is diligently paying down the voter-approved bond debt and the China Spring ISD tax rate has already dropped by 25 cents.

China Spring ISD Tax Rate

Understanding Tax Compression

In Texas, the state uses a system called tax compression to lower the school district tax rate that local homeowners pay each year. This primarily affects the Maintenance & Operations (M&O) tax rate, which helps fund everyday school expenses such as teacher salaries, classroom supplies, and utilities. When the state has extra money in its budget, it uses that funding to help “buy down” local tax rates, shifting some of the cost of public education from local property taxes to the state budget.

Why a lower tax rate doesn't always mean a lower tax bill.

Although the tax rate goes down each year, many homeowners don’t see their total tax bill decrease. That’s because your school tax bill is based on two factors: the tax rate and your home’s appraised value. As property values in Texas continue to rise, the lower rate is applied to a larger number—meaning your overall taxes can stay the same or even go up.

Tax compression and the impact on school funding.

As the local share of school funding decreases due to tax compression, the state increase its share to keep total funding stable. But in practice, it doesn’t always work that way. The formulas used by the state do not guarantee a dollar-for-dollar replacement of local revenue. As a result, many school districts actually receive less total funding after compression than they did before.

Recent funding increase still falls short.

The Texas Legislature recently approved a $55 increase to the Basic Allotment, which is the base amount schools receive per student. However, that amount is well below what is needed to keep up with rising costs and inflation. Since 2019, inflation has increased by more than 25%, while school operating costs in Texas have risen by at least 14–19%. Experts estimate schools would need about a $1,100 increase per student just to break even.

2021 Bond Facilities

Texas Public School Funding

In Texas, public schools are funded by three main sources:

Local Funding

State Funding

Federal Funding

At China Spring ISD 39.5% of funding comes from local property taxes, 58% of funding comes from state funding, and 2.5% comes from federal funding. The China Spring tax rate accounts for only 39.5% of the total budget at China Spring ISD.

The Texas Legislature determines how much funding public schools receive and the total funding amount does not change. If property taxes increase, the local funding source increases for public schools. However, state funding decreases to accommodate for increases in local funding.