Revenues projected on 95.75% attendance for the 2025-26 academic year.

China Spring ISD School Budget

Your tax dollars are at work in our schools, supporting our students and educators every day. China Spring ISD is dedicated to responsibly managing school funds while being transparent with our community.

Operating Budget

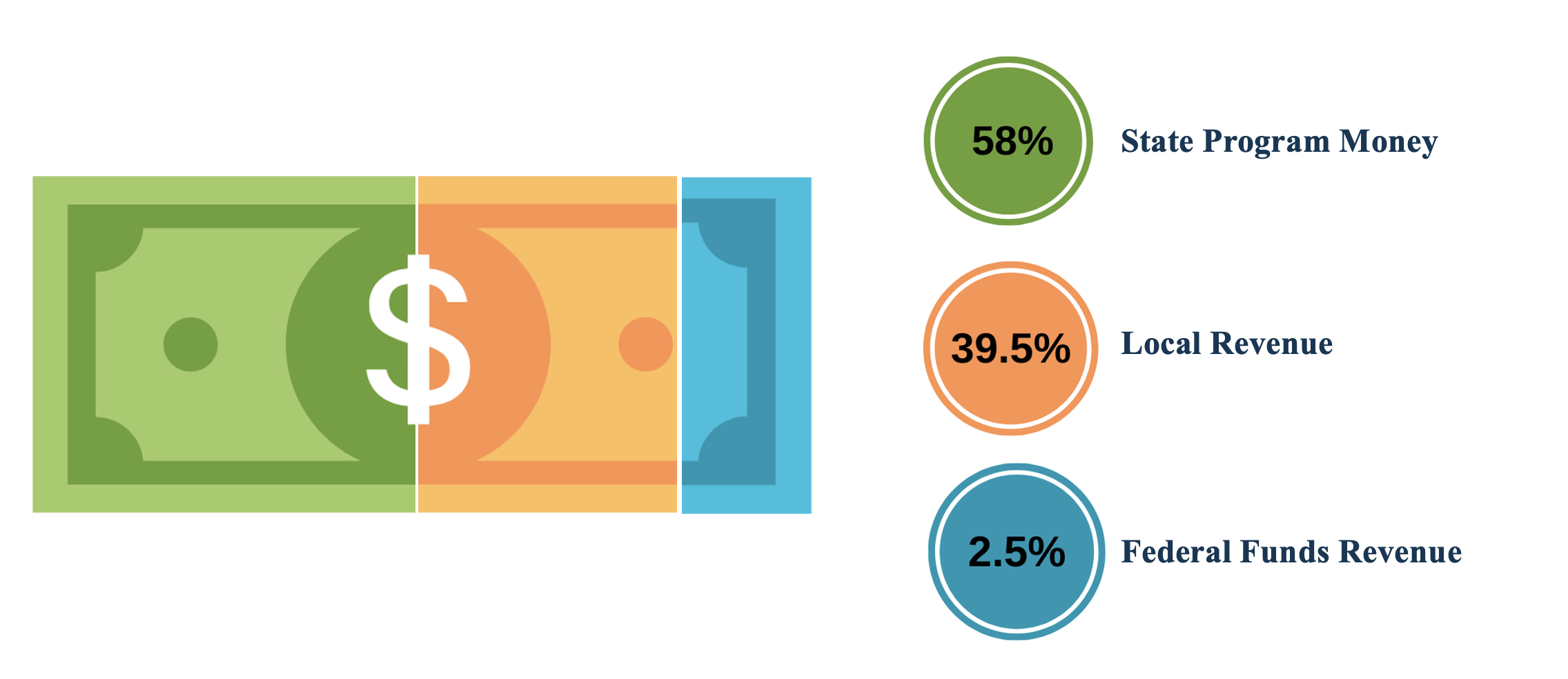

China Spring ISD projects revenues totaling $38 million for the 2025-26 academic year.

Where does the money go?

The budget is organized into three general funds. Fund 599 is debt service. The money in fund 599 is specifically for paying voter-approved debt secured through bond elections. Fund 599 accounts for 12.5% of revenues. Texas state law mandates money from fund 599 can only be used toward voter-approved debt.

Fund 240 is food service. The money in fund 240 goes directly to support child nutrition services at the district. From providing food, to purchasing new kitchen appliances, Fund 240 accounts for 4% of revenues. Texas state law mandates money from fund 240 can only be used toward child nutrition services.

Fund 199 is the largest fund at China Spring ISD, funding teacher salaries, school supplies, facility repairs, and professional development for staff. Fund 199 accounts for 84% of revenues at the district. Within fund 199, 80% of funds is allocated for employee salaries, 10% for fixed expenses such as electricity, fuel for buses, and phone services. Leaving the remaining 10% of the district budget for technology, school supplies, and curriculum programs.

Approximately 80% of the district's budget is allocated for personnel costs for our educators, administrators, and support staff.

Understanding the budget deficit.

China Spring ISD has an operating budget of slightly more than $39.7 million, with revenues projected of $38.7 million. This budget reflects all three primary funds: 599, 240, and 199.

Fund 199 is the largest fund at China Spring ISD, and it is the fund over which the district has the most discretion for how funds are allocated. When the district adopts a new budget, we are primarily focusing on the revenue and expenses within fund 199. Within fund 199, 90% of expenses cover fixed costs, such as teacher salaries, utilities, and property insurance. The remaining 10% supports technology, school supplies, curriculum programs, and other needs.

Funds 599 reports a budget surplus, these funds are restricted by law and can only be used to pay voter-approved debt. The surplus ensures the district can meet upcoming bond payment schedules on time, but it cannot be used to support operating expenses or other programs.

Fund 240 operates under strict federal and state regulations. This fund currently has a positive fund balance, or savings account, meaning there is a surplus of revenue collected in previous years. However, the district is projecting a deficit in this fund for the upcoming year as we plan to spend down the fund balance in compliance with requirements set by the Texas Department of Agriculture.

Fund 599 and 240 cannot be used to offset the budget shortfall projected in Fund 199. Instead, the district will draw from the general fund balance reserves (similar to a savings account) to cover the gap in the coming year.

Fund 599

Projected Expenses

$4,478,654

Projected Revenue

$4,628,654

Fund 240

Projected Expenses

$1,370,256

Projected Revenue

$1,362,314

Fund 199

Projected Expenses

$32,667,863

Projected Revenue

$31,473,073